You know the old saying. "Invent a new and useful bandalore, and the world will beat a path to your door."

The Inventions in Everything team lives by that motto. And what better way to seek out new and useful bandalores than seeking them out among the more than ten million patents awarded by the U.S. Patent Office.

Although we had gone seeking the oldest patent for a different invention, we chanced across U.S. Patent 59,745, which was issued by the U.S. Patent Office on 20 November 1866. The patent's abstract proclaims the inventors' achievement:

Be it known that we, James L. Haven and Charles Hettrick, both of Cincinnati, Hamilton county, Ohio, have invented a new and useful bandalore, and we do hereby declare the following to be a full, clear, and exact description thereof, reference being had to the accompanying drawings making part of this specification.

By this point, you're probably wondering just what a bandalore is. As they used the word, it seems to have become a name lost to history, soon replaced by the more futuristic name that inventors Haven and Hettrick gave to their invention: The Whirlygig!

Oddly enough however, that name never caught on for the modern incarnation of what they invented. Their new and improved bandalore is much better known today as the yo-yo. Here are Figures 1, 2, and 3 from the patent illustrating their vision of a new and useful bandalore.

Although not as refined as what today's versions of it have become, Haven and Hettrick's invention is immediately recognizable as a yo-yo. Speaking of which, we easily found where you can buy the more modern versions of their "new and useful bandalore" in beginner, intermediate, and expert level models.

Unless you're an intense yo-yo enthusiast, its unlikely you'll ever come across the name "bandalore" in any product catalog. Perhaps it's a name that can be resuscitated in the future by the inventors of a new and useful whirlygig, which is a name that's now most closely associated with today's garden spinners. Stranger things have happened.

From the Inventions in Everything Archives

The IIE team has never previously featured a bandalore, but we have featured a couple of other inventions that fall into the category of "new and useful" toys:

Labels: technology

April 2024 proved to be yet another mixed month, on net, for the dividend paying stocks of the U.S. stock market.

By net, we're adding the positives and subtracting the negatives to be found in the month's dividend metadata. After doing that math for the month's favorable and unfavorable dividend changes, we ended up with a month-over-month net change of -10, which is to say the unfavorable changes mildly outnumbered the favorable ones. Year-over-year however, we find a more positive outcome. Favorable dividend changes outnumbered unfavorable changes by margin of 27.

For the month-over-month change, we had the positive of a reduced number of decreased dividends reported by Standard and Poor, which was more than offset by the negative of a reduction in the number of favorable dividend changes. By contrast, the year-over-year numbers are much less ambiguous. The number of favorable dividend changes rose while the number of unfavorable dividend changes decreased, which leads to its more positive score.

We're playing around with describing the dividend metadata this way because with so many moving pieces, getting to single values that describe how the dividend paying firms of the U.S. stock market performed could be useful. As for where the numbers we used to determine these net scores came from, the following table summarizes the values that S&P reported that encompass April 2024's dividend changes:

| Dividend Changes in April 2024 | |||||

|---|---|---|---|---|---|

| Apr-2024 | Mar-2024 | MoM | Apr-2023 | YoY | |

| Total Declarations | 5,367 | 5,306 | 61 ▲ | 3,169 | 2,198 ▲ |

| Favorable | 181 | 200 | -19 ▼ | 130 | 51 ▲ |

| - Increases | 124 | 130 | -6 ▼ | 91 | 33 ▲ |

| - Special/Extra | 57 | 67 | -10 ▼ | 39 | 18 ▲ |

| - Resumed | 0 | 3 | -3 ▼ | 0 | 0 ◀▶ |

| Unfavorable | 6 | 15 | -9 ▼ | 30 | -24 ▼ |

| - Decreases | 6 | 15 | -9 ▼ | 30 | -24 ▼ |

| - Omitted/Passed | 0 | 0 | 0 ◀▶ | 0 | 0 ◀▶ |

The following chart visualizes the monthly counts of dividend increases and decreases from January 2004 through April 2024.

With S&P reporting just six firms announcing they would reduce their dividends during the month, which is well below the threshold of fifty firms that corresponds with recessionary conditions that affect dividend paying firms in the U.S., we'll skip providing a breakdown of the affected industrial sectors this month.

Perhaps the most disappointing aspect of April 2024 is that its favorables were not stronger. Looking over the past 21 years for which S&P has reported its dividend metadata, April 2024 ranks in the bottom fifth for the number of announced dividend increases. Meanwhile, there were 57 special, or extra, dividends announced during the month, ranking it among the highest recorded for Aprils from 2004 through 2024. April 2024 is second overall only behind April 2014's total of 61 extra dividends announced.

That's where we find the cloud lurking in the silver lining of these favorable dividend changes. If U.S. firms were more confident they could sustain higher dividend payments into the future, we should see more dividend rises and fewer special dividend payments. April 2024's elevated number of extra dividend announcements instead suggests many of these firms do not anticipate being able to sustain higher dividend payments going forward at this time. Yet they can afford to pay a special dividend because of how well they've done in the very recent past.

In April 2014, the elevated number of extra dividends announced presaged a multi-year decline for the dividend paying firms of the U.S. stock market after reaching a high level. If the management of that era believed that their future business outlook would be less bright going forward than it had been, the message they sent with April 2014's extra dividend payments was right on the money.

Ten years later, what message do you suppose the management of the firms taking similar action in April 2024 are sending about how they view their prospects?

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 May 2024.

Image credit: The Minister of State (Independent Charge) for Consumer Affairs, Food and Public Distribution, Professor K.V. Thomas receiving a dividend cheque from the Chairman, Central Warehousing Corporation, Dr. C.V. Ananda Bose by Government of India on Wikimedia Commons. Creative Commons CCO 1.0 DEED CC0 1.0 Universal. Although this photo comes from India, we really like the idea of a really big dividend cheque!

Labels: dividends

Motio Research reports median household income increased in March 2024. The firm estimates the income earned by a typical American household increased by $906 (+1.2%) from its initial estimate of $77,265 for Febuary 2024.

Motio Research's estimates are based on income data collected by the U.S. Census Bureau as part of its monthly Current Population Survey. The firm adjusts its monthly estimates to account for the effects of seasonality and inflation in its data, presenting its results in the form of an index with the median household income of January 2010 assigned a value of 100. The initial value of the firm's U.S. Real Median Household Income Index for March 2024 is 116.0, rising above the index' pre-pandemic February 2020 level for the first time.

The following screenshot of Motio Research's interactive chart shows how this index has changed from January 2010 through March 2024:

Analyst's Notes

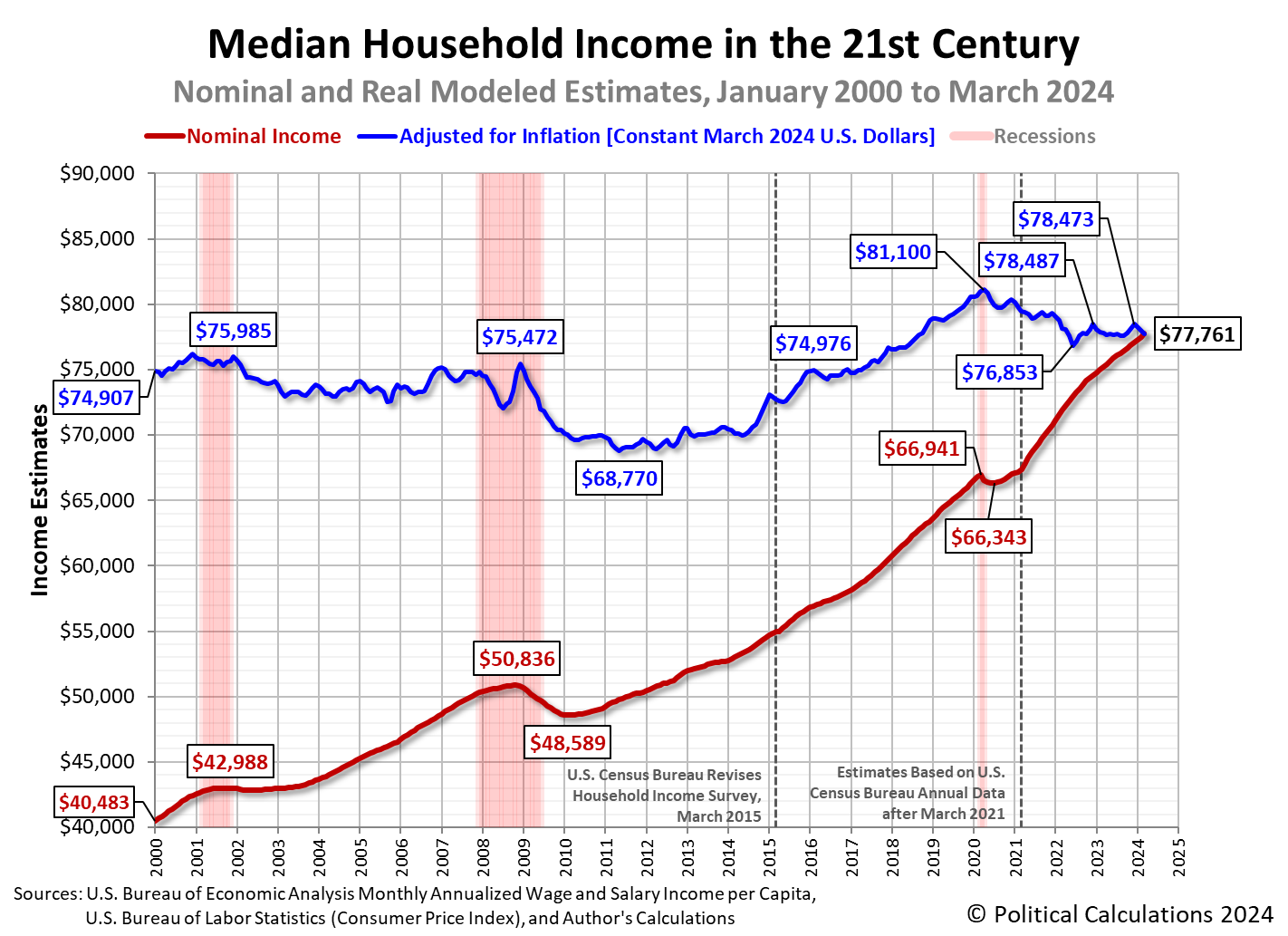

Political Calculations produces estimates of median household income that complement the monthly survey-based estimates produced by Motio Research. Our initial estimate of median household income in March 2024 based upon our alternate methodology is $77,761, which is $253 (+0.3%) higher than our initial estimate of $77,508 for February 2024. Our March 2024 estimate is $410 below Motio Research's initial survey-based estimate for the month.

The latest update to Political Calculations' chart tracking Median Household Income in the 21st Century shows the nominal (red) and inflation-adjusted (blue) trends for median household income in the United States from January 2000 through March 2024. The inflation-adjusted figures are presented in terms of constant March 2024 U.S. dollars and are not seasonally adjusted, unlike the data used to produce Motio Research's Household Income index:

The most important data series shown in the chart is the nominal, non-inflation adjusted monthly median household income estimates, which sets the bar for the "typical" American household's purchasing power. That's because Americans can only pay their bills in terms of nominal, non-inflation adjusted, non-seasonally adjusted dollars out of their nominal, non-inflation adjusted, non-seasonally-adjusted household incomes. Here the important thing to note is that the year-over-year growth rate of median household income has been essentially flat since September 2023, increasing at an annualized rate of 3.3 to 3.4% during the last seven months, the slowest pace at which it has increased since May 2021.

Finally, a quick note about the underlying data we use in developing our alternate median household income estimates. The U.S. Bureau of Economic Analysis made minor upward adjustments of less than 0.1% in the aggregate income estimates we use in crafting our estimates for both January and February 2024.

For the latest in our coverage of median household income in the United States, follow this link!

References

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 26 April 2024. Accessed: 26 April 2024.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 26 April 2024. Accessed: 26 April 2024.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. Not seasonally adjusted. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 10 April 2024. Accessed: 10 April 2024.

Image Credit: California Tax Service Center. Public domain image.

Labels: median household income

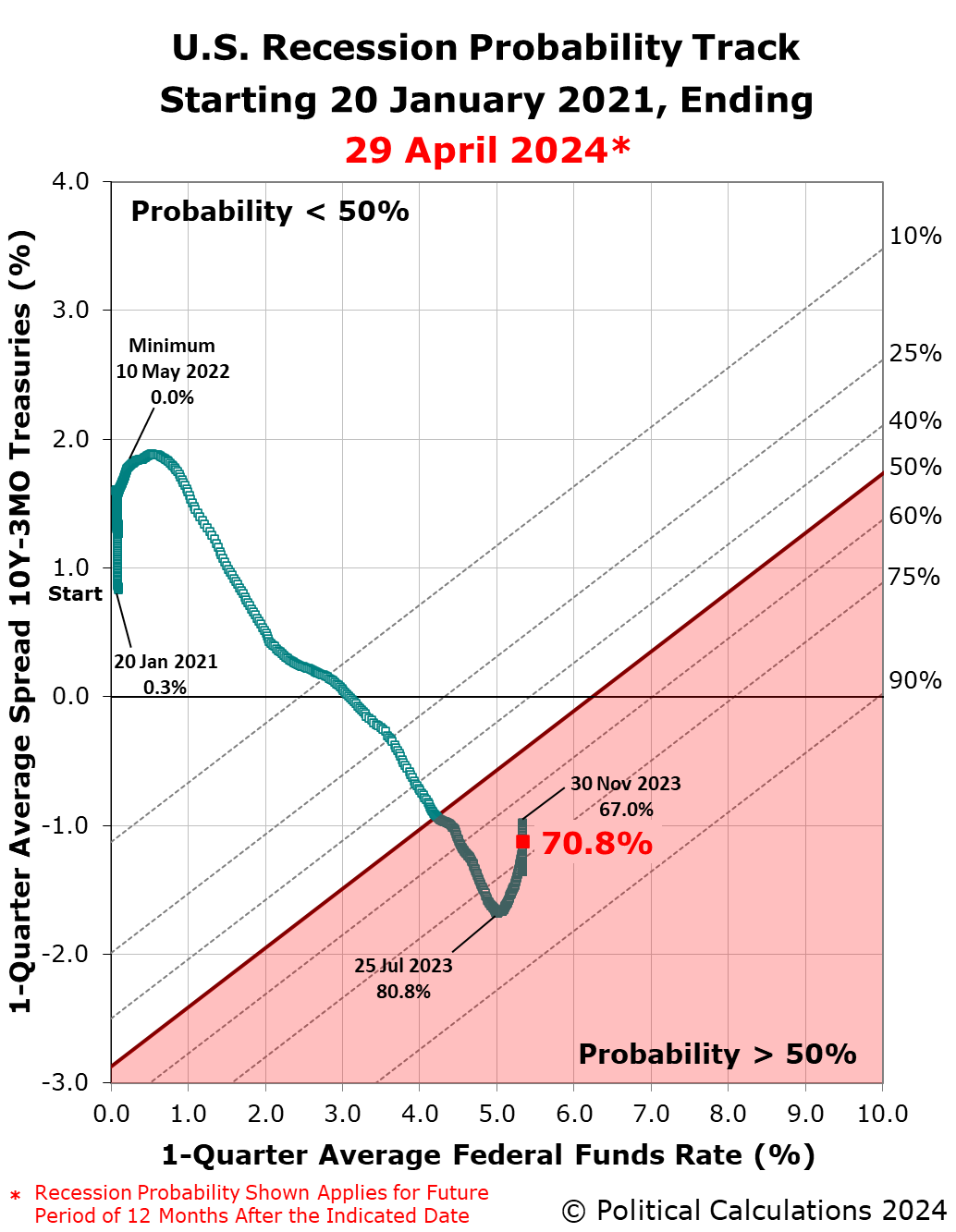

The probability the U.S. economy will see a recession begin sometime in the next twelve months has started to fall again during the past six weeks. after having hit a double-top.

Since our previous update, the probability has dropped from over 76% to just under 71%, confirming the double-top after having previously peaked at 81% in July 2023.

These probabilities are determined using a recession forecasting method developed for the Federal Reserve Board in 2006. They represent a portion of the economic data and forecasts Federal Reserve officials will consider as they meet from 30 April to 1 May 2024 to review how they will set the level of short term interest rates in the United States in the months ahead. The expected timing of rate cuts by the Fed has been slipping later and later during the past six weeks.

The following chart presents the latest update of the Recession Probability Track. It reveals how that probability appears as the Federal Reserve's Open Market Committee (FOMC) goes into its April 2024 meetings to review and potentially change the Federal Funds Rate (FFR). The FOMC is expected to continue holding the FFR steady at this meeting, but is expected to start lowering this core interest rate at later meetings in 2024. Markets anticipate the Fed may cut this interest rate at its September 2024 meeting.

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 29 April 2024 and 29 April 2025.

The double-top pattern we've described at the beginning of this article can be better seen by simply tracking the recession probability over time. The next chart shows that forecast probability using the data available from 30 April 1983 through 29 April 2024, with the probabilities shown shifted 12 months into the future to coincide with the end of the period in which they apply.

The probability of recession peaked at nearly 81% on 25 July 2023, making the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction. The prolonged elevation of the Federal Funds Rate combined the deepened inversion of the U.S. Treasury yield curve in recent weeks has made the period between 18 March 2024 and 18 March 2025 the second most-likely period that will include the peak of a business cycle that marks when a recession began.

Another way to interpret the double-top pattern is to consider that it extends the period in which the highest probability of recession is elevated. Under that interpretation, the period in which the probability of an official recession starting would be greater than 70% is running from 25 July 2023 through at least 29 April 2025.

Only time will tell if that's an appropriate way to interpret the data. Looking at the underlying data that's used to determine the recession probability, we anticipate it will continue falling in the near term, making a "triple-top" event unlikely.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have provided a tool to make it easy to do.

We will continue following the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold. We're curious to see how this forecasting method performs.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- Recession Probability Falls After Hitting Double-Top

- U.S. Recession Probability Nears a Double-Top

- Probability of U.S. Recession Resurges to Nearly 75%

- U.S. Recession Odds Recede to Two Out of Three Chance in 2024

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image Credit: Microsoft Copilot Designer. Prompt: "A signpost with the words 'Recession Ahead?'"

Labels: recession forecast

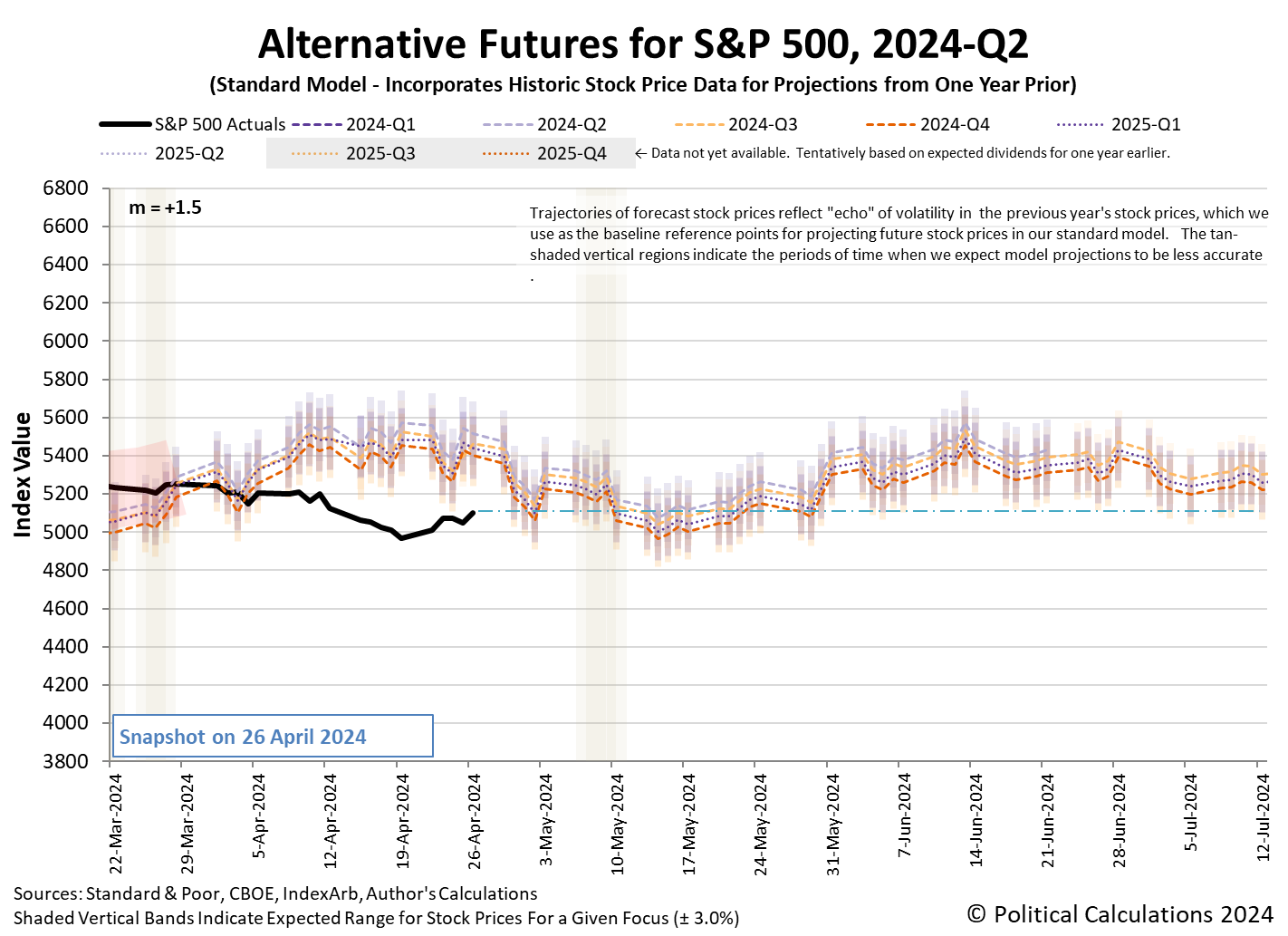

It was a good week for the S&P 500 (Index: SPX) jumped almost 2.7% over the previous week. The index closed the fourth week of April 2024 at 5,099.96.

There were three main drivers behind the positive change from the preceding week:

- The world's biggest publicly-traded company Microsoft (NASDAQ: MSFT) experienced what one analyst called a "drop the mic moment", as its cloud computing division and especially its artificial intelligence (AI) initiatives boosted its bottom line.

- Alphabet (NASDAQ: GOOG and GOOGL) also reported booming earnings and announced it would initiate a dividend to shareholders of its stocks. The company's market cap surged above $2 trillion on that news.

- The expected timing for when the Fed will cut interest rates stopped slipping. The CME Group's FedWatch Tool held steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3), the same as expected a week earlier, but now looking much less shaky. The tool projects the Fed will cut the rate by 0.25% on that date, which is now expected to hold at its new level for the next six months.

We think that last development to prompted investors to shift their forward investment horizon from 2024-Q4 back toward 2024-Q3. Here's the latest update of the alternate futures chart.

Here are the week's other market-moving news headlines:

- Monday, 22 April 2024

-

- Signs and portents for the U.S. economy:

- IMF's Gopinath says high U.S. deficits fueling growth, higher interest rates

- US consumers on lower incomes face loan stress while banks pull back

- Fed minions feel "no urgency" going into pre-FOMC meeting blackout period:

- Bigger trouble developing in China as tax cut stimulus takes effect:

- Souring China dreams force Western financial firms to cut costs

- China's state planner warns intensified EV price war on oversupply

- China's Q1 fiscal revenue falls as tax cut policies weigh

- BOJ minions thinking about hiking rates, propping up yen:

- ECB minions excited about cutting rates in June 2024, getting tired of following Fed's lead:

- Middle East tensions should not delay ECB's June rate cut, Villeroy says

- ECB governors fear political pressure over Fed-style 'dot plot'

- Nasdaq, S&P, and Dow closed on top as earnings season rolls on

- Tuesday, 23 April 2024

-

- Signs and portents for the U.S. economy:

- US business activity cools in April; inflation measures mixed

- Oil falls back after robust EU data as Mideast tensions linger

- Shortages key to copper's upward price trajectory to new peaks

- US new home sales rebound to six-month high; rising mortgage rates a concern

- BOJ minions say they'll hike interest rates if inflation rises above their target, preparing to prop up yen:

- BOJ will hike rates if trend inflation accelerates, gov Ueda says

- Yen's slide toward 160 level could trigger action, says senior ruling party official

- Japan may intervene to support yen any time, says senior ruling party official

- Japan issues strongest warning yet on readiness to intervene in currency market

- ECB minions thinking about cutting rates to prop up Eurozone economy:

- ECB governors stick to plan for multiple rate cuts despite global headwinds

- June ECB rate cut firmly in play; but slower easing now expected

- Nasdaq, S&P, Dow rise as Wall Street rebounds for a second straight day; Tesla reports

- Wednesday, 24 April 2024

-

- Signs and portents for the U.S. economy:

- Slow, but solid US economic growth anticipated in Q1; inflation likely heats up

- Oil settles lower as U.S. business activity cools, concerns over Middle East ease

- Bigger bailouts developing in China:

- Country Garden allowed to postpone first payments on three onshore bonds

- Exclusive: China turns the heat up on cross-border investments in local govt debt, sources say

- BOJ minions thinking more about how and when to prop up yen:

- ECB minions thinking about what to do after they start cutting rates:

- Nasdaq, S&P, Dow end little changed amid Tesla surge, industrials slump & rise in yields

- Thursday, 25 April 2024

-

- Signs and portents for the U.S. economy:

- Q1 US GDP shows surprise slowing and uncomfortable inflation

- Oil eases as US demand concerns outweigh Middle East fears

- Fed minions whinging over mixed signals sent by U.S. economic data:

- Confounding US economic, inflation data muddy Fed's rate path

- Weak GDP, strong prices, highlight Fed dilemma

- BOJ minions getting more worried about falling yen, thinking they may have to do something about it:

- ECB minions worry about inflation, Eurozone government officials want to make ECB minions worry about more than that:

- ECB most concerned about wages, services, Schnabel says

- ECB should not only target inflation, Macron says

- Nasdaq, S&P, Dow dip after GDP print fans stagflation worries; Meta plunges post earnings

- Friday, 26 April 2024

-

- Signs and portents for the U.S. economy:

- Fed minions still expected to deliver rate cut in September 2024:

- BOJ minions do nothing to change interest rates to combat inflation or to prop up Japan's currency:

- BOJ keeps low rates, hints of future rate hikes fail to stem yen fall

- Japan frets over relentless yen slide as BOJ keeps ultra-low rates

- Microsoft, Alphabet gains propel Nasdaq to best day since Feb; S&P, Dow also rise

The U.S. Bureau of Economic Analysis' first estimate of the real GDP growth rate in 2024-Q1 is +1.6%, well below the +2.9% growth rate forecast by the Atlanta Fed's GDPNow toola week ago. The BEA will revise its GDP growth rate estimate twice during the next two months. In the meantime, the Atlanta Fed's GDPNow tool has turned its forward-looking focus to how fast real GDP will grow during 2024-Q2 with an initial forecast of +3.9% growth for the quarter.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a jumping bull wearing a sign"

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.